Introduction

The recent Trump tariff announcement has sent shockwaves across global markets, affecting multiple industries and international trade relationships. As the Trump tariffs come into effect, businesses and investors are scrambling to understand their implications. The tariff announcement introduces sweeping changes in US trade policies, with a focus on reciprocal tariffs aimed at leveling the playing field for American businesses.

Understanding Tariffs

What are tariffs? Tariffs are taxes imposed on imported goods, typically used to regulate trade, protect domestic industries, and generate government revenue. The new tariff list includes significant duties on imports from major trading partners like China, India, and Vietnam.

Key Aspects of Trump’s Tariffs

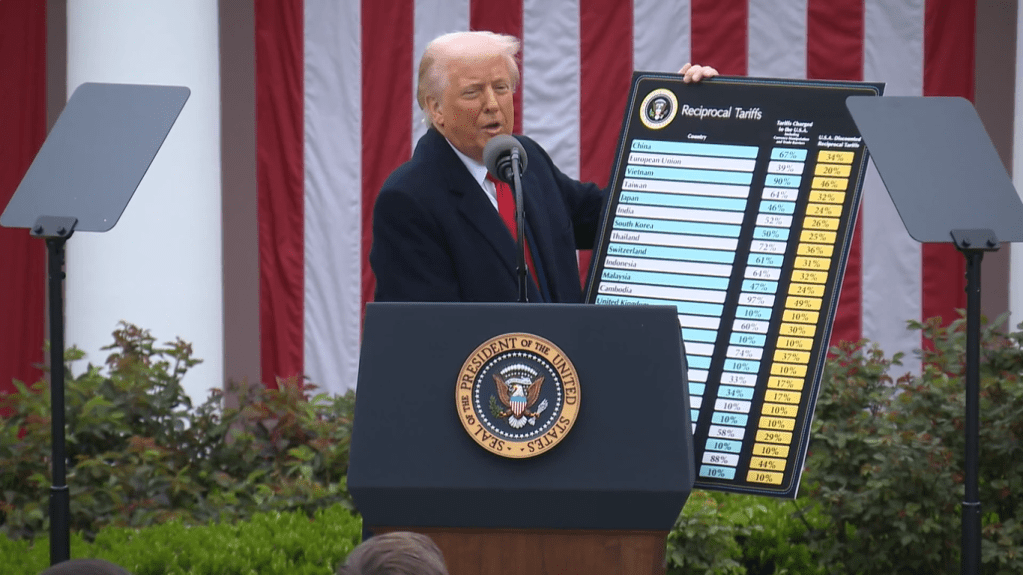

- Reciprocal Tariffs Chart: The US has implemented a reciprocal tariff strategy, imposing higher tariffs on countries that maintain significant trade barriers against American products.

- Trump Tariff Chart: The new tariff structure includes universal 10% tariffs on all imports, with additional levies on select countries reaching up to 54%.

- USMCA Considerations: While the USMCA (United States-Mexico-Canada Agreement) remains intact, Canada and Mexico will face selective tariff increases.

- Trump Tariffs List: Major sectors affected include automobiles, steel, aluminum, technology, and consumer goods.

- Trade Deficit Reduction: The administration argues that these tariffs will help reduce the US trade deficit by promoting domestic production.

Global Response

- India: The Indian government is assessing the impact of a 27% reciprocal tariff and is in discussions for a bilateral trade agreement to mitigate the effects.

- Vietnam: The country faces a hefty 46% tariff, significantly affecting its manufacturing sector.

- China: Facing a 54% tariff on exports, China has vowed retaliation, further escalating the ongoing trade war.

- European Union: The EU is preparing countermeasures and negotiating with US officials to reduce tariff burdens.

- Russia: Interestingly, Russia tariffs were not included in the initial list due to existing trade sanctions.

Market Impact

- Stock Market Reaction: US equity markets saw significant declines, with Wall Street Journal reporting a 3.4% drop in S&P 500 futures.

- Currency Movements: Investors moved towards safe-haven assets, leading to a US dollar slump and gains in the Swiss franc and Yen.

- Oil Prices: The uncertainty caused a 4% drop in oil prices due to fears of reduced global demand.

- Tech Sector: Major firms like Tesla (TSLA premarket) saw volatility due to supply chain concerns.

Expert Opinions

- Scott Bessent, a notable economic strategist, stated on Fox Business that the tariffs could either boost domestic manufacturing or create inflationary pressure.

- White House Commerce Secretary Howard Lutnick defended the move as a “reordering of fair trade.”

Media Coverage and Public Reactions

The tariff announcement dominated global news networks such as Fox News Live, CNN News, CBC News, and Reuters. Laura Ingraham and News Channel 4 provided extensive coverage on Trump tariffs April 2, which coincided with Liberation Day tariffs.

What’s Next?

- When do tariffs go into effect? The first phase begins April 5, with additional tariffs taking effect on April 10.

- Who pays tariffs? While imposed on foreign goods, tariffs often result in higher prices for American consumers.

- Trump’s Future Announcements: Speculation continues regarding a potential Trump press conference today in the White House Rose Garden to clarify further trade policies.

Conclusion

The Trump tariff news marks a significant shift in US trade policy, with long-term ramifications for global commerce. While some believe these tariffs will strengthen American manufacturing, others fear they could trigger economic instability. The coming weeks will reveal the true impact of Trump’s tariffs on businesses, consumers, and global trade relations.